The Management and Staff wish all customers old & new a very merry Christmas and a happy New Year.

The Management and Staff wish all customers old & new a very merry Christmas and a happy New Year.Welcome to the Ferguson Oliver blog designed to keep clients, staff and anyone with an interest in Ferguson Oliver and our services informed.

Tuesday, 23 December 2008

Festive Greetings

The Management and Staff wish all customers old & new a very merry Christmas and a happy New Year.

The Management and Staff wish all customers old & new a very merry Christmas and a happy New Year.Monday, 15 December 2008

Fidelity fund guru Anthony Bolton believes the new year will usher in a fresh bull market for investors. Bolton says that although this is the worst financial crisis he has seen in his 30 years in fund management, all the indicators like cheap valuations show that the bottom is there.

Fidelity fund guru Anthony Bolton believes the new year will usher in a fresh bull market for investors. Bolton says that although this is the worst financial crisis he has seen in his 30 years in fund management, all the indicators like cheap valuations show that the bottom is there.He says that a bull market is likely in the first quarter of 2009 followed by a period of consolidation.

Bolton, who ran Fidelity's flagship special situations fund from 1979 to 2007 has also called the bottom of the hugely troubled commercial property market.

He says: "Prime property is yielding 7.5 per cent at a time when there is a shortage of yield elsewhere. There are risks, but long leases protect you in the short term - unless the tenant goes bust. Some will go under but even if you lose 5 or even 10 per cent of your income, that's still 90 per cent that's protected for the next 10 years.

As for next year's rally Bolton tips financial stocks and consumer cyclicals to lead the bounce. He also believes owning a basket of banks is the best option.

"In 28 years I have nearly always been underweight in banks. They are opaque and impossible to analyse so I have generally been against them. However, sentiment has become extreme and governments have strengthened their balance sheets. One or two may have to raise additional capital, but that is why you should own a basket."

Monday, 8 December 2008

Cost to live !

A typical eighteen year old will need just over £1.7m to sustain an average standard of living until death, according to a survey by Axa designed to shock people into saving.

A typical eighteen year old will need just over £1.7m to sustain an average standard of living until death, according to a survey by Axa designed to shock people into saving.The study also found, a 25 year old will need just over £1.5m in today’s money, a 35 year old, £1.25m, a 45 year old, £0.9m and a 55 year old £0.6m to maintain an average standard of living.

Axa surveyed approximately 2,100 people to calculate the monthly expenditure of everything from accommodation, transport and groceries to pets and holidays.

The average person spends about £240 on groceries, £68 on going out, £24 on hobbies and gives nearly £10 to charity every month. With essential outgoings added, this amounts to an average annual expenditure of approximately£28,455, worryingly higher than the median average annual pay for full time employees, of £24,908.

Axa believes better financial planning could reduce the average total expenditure considerably; calculating people could save as much as £737 by focusing on their money worries, while regular monthly reviews of finances could shave tens and thousands of pounds off lifetime expenditure.

Friday, 28 November 2008

Mother of all bear rallies

Here is an interesting take on current events. I must admit to some sympathy with the writer as I can identify with signs that managers are starting to find value in certain markets.

Here is an interesting take on current events. I must admit to some sympathy with the writer as I can identify with signs that managers are starting to find value in certain markets. Some market professionals I’ve spoken to agree with this view and are looking for a move 30% higher from the recent lows to the end of December. If we equate that with the recent lows on the FTSE, we could be looking at somewhere between 4,800 and 5,000 points, about 675 points higher than Thursday’s close."

Monday, 24 November 2008

JPM Natural Resources

Tuesday, 18 November 2008

Beware Cold Callers !

Cold called and offered a red hot share tip? Be very aware, it could turn out a lot hotter than expected. So hot, in fact, that the shares (and your money) vaporise in the intense heat of this boiler room trading scam.

Cold called and offered a red hot share tip? Be very aware, it could turn out a lot hotter than expected. So hot, in fact, that the shares (and your money) vaporise in the intense heat of this boiler room trading scam.You may be disenchanted with current investment opportunities and performance in these credit-straitened times, but don't let your enthusiasm to reassess and realign your investment portfolio turn you into the perfect prey for a smooth-talking, ever so convincing salesperson.

Yes, we are in a bear market and an exciting share offer will always have a 'grass looks greener' feel to it. Yet that grass will not only be just as tough to mow, it could also dry up and become your very own financial dustbowl. Boiler rooms are high pressure sales firms, unauthorised and often based offshore, that specialise in worthless investments. They target investors illegally, offering overpriced, non-tradable and often non-existent shares. Collectively UK investors donate upwards of £500 million to such hucksters each year. The average individual loss is around £20,000, although the Financial Services Authority (FSA) has reported a case where the investor lost £500,000 and it believes many others are too embarrassed to admit being swindled by boiler room activity.

Not that it would do them any good. Because such sales outfits are unauthorised, the Financial Services Compensation Scheme cannot offer redress to victims of boiler rooms. Hence the FSA has now teamed up with the main company registrars to warn investors. Together with the Institute of Chartered Secretaries and Administrators (ICSA) Registrars Group, the FSA is urging stockmarket-listed companies to include warning leaflets about boiler room scams in their communications with shareholders.

What you should do: If you pick up the phone and get some smooth patter about the benefits of investing in shares of a company you've never heard of, get the caller's company name and say you will phone back. Ignore protestations about 'time is tight and the offer could be withdrawn.'

Then check the FSA website to see if the company is authorised or whether it is on the black list of some 500 known financial rogues. Report to this City watchdog any firms that cold call you offering to sell shares. The FSA in the past 18 months has taken action against seven firms operating as boiler rooms or working on behalf of such scams. Its recently updated leaflet explains how to identify and what to do about them should they contact you.

Thursday, 6 November 2008

Inflation, Deflation... Where next

First it was oil, now it’s the goods we buy on the High Street. It’s funny. While all around doom and gloom is the staple diet, the best bit of economic good news we have received for a very long time has barely been noticed. The latest data out from the British Retail Consortium (BRC) revealed that both food and non-food inflation turned negative in October.

First it was oil, now it’s the goods we buy on the High Street. It’s funny. While all around doom and gloom is the staple diet, the best bit of economic good news we have received for a very long time has barely been noticed. The latest data out from the British Retail Consortium (BRC) revealed that both food and non-food inflation turned negative in October.The annual figures are still well into positive territory, of course, with the BRC recording the annual rate of food inflation at 7.5 per cent. Non-food annual inflation stands at 0.7 per cent and the combined rate at 3 per cent. But you need to bear in mind, 12 months’ worth of data make up the annual figures and, therefore, it takes a year before changes work their way out of the system.

Annual food price inflation peaked in August, hitting 10 per cent, whereas month on month food inflation peaked in the previous month when prices rose by 1.9 per cent in just the one month. But ever since then, the trend has been down. Food inflation rose by just 0.3 per cent in August and turned negative in September. But October was the first month which saw negative month on month food and non-food inflation for a very long time. Overall, prices were down 0.1 per cent in the month, the first fall this year. But, expect the decline to accelerate. We could be just six months or so away from seeing the annual rate of food and non-food inflation go negative.

Falling food and oil prices will also afford the Bank of England greater leeway in cutting interest rates – of course. By the time you read this, you will probably know how much the Bank of England has chosen to cut interest rates.

The time is now right to cut rates in a big way. The UK’s central bank could easily justify knocking 1.5 percentage points off interest rates. It probably won’t, a half a per cent is far more likely, given the bank’s usual cautious approach. In any case, the full extent of rate cuts won’t be passed on by the banks. But the trend is clear. Interest rates, and in turn the monthly amounts mortgage holders have to fork out for their payments, are all set to fall.

Thursday, 30 October 2008

0% Interest Rates !

Zero interest rates are on their way. They could be days off in Japan, weeks off in the US and, maybe, months off in the UK. The decade beginning in the year 2000, and finishing in 2010, may be known as the noughties for more than one reason.

Zero interest rates are on their way. They could be days off in Japan, weeks off in the US and, maybe, months off in the UK. The decade beginning in the year 2000, and finishing in 2010, may be known as the noughties for more than one reason.Yesterday, the Fed cut interest rates to 1 per cent. And its chairman, Ben Bernanke dropped a big hint they will be cut again. “Downside risks to growth remain,” said the official Fed statement, and then talked about “levels consistent with price stability.”

Rumours that the Central Bank of Japan is set to cut rates back to zero have been doing the rounds for a couple of days now. In fact, it is these rumours that have lain behind the surge in stock markets around the world over the last couple of days, with the Dow enjoying its second-highest daily rise ever, on Tuesday, and the FTSE 100 its third-best day ever, yesterday.

And what about the UK? Yesterday, Capital Economics said: “Extraordinary circumstances require extraordinary actions. With the current recession likely to be deeper than that in the early 1990s and the credit crunch impairing the effectiveness of monetary policy, we now expect UK interest rates to fall to an all-time low of just 1 per cent.”

Earlier this week, former MPC member and extremely illustrious economist, Charles Goodhart, told Channel 4: “Interest rates will go down from now, by how far and how fast nobody knows… They could go to zero. They went to zero in Japan in the 1990s when the Japanese had a recession or depression which went on for a long time and was quite severe.”

Monday, 27 October 2008

Irish Government Extends Guarantee to I of M.

Further to our previous postings in relation to the security offered by The Irish Government we are pleased to see today's announcement lifting some of the uncertainty floating around just now.

Further to our previous postings in relation to the security offered by The Irish Government we are pleased to see today's announcement lifting some of the uncertainty floating around just now.The Irish government has confirmed four banks and two building societies will be protected by its bank guarantee scheme safeguarding offshore savers in the Isle of Man.

Irish Minister for Finance Brian Lenihan signed the order on Friday night after the six lenders agreed to be in the scheme, which will protected 100% of depositors’ savings. The guarantee makes the protected Irish banks more attractive than other Isle of Man deposit takers, who are only covered for the first £50,000 by the Manx Depositors Compensation Scheme. ‘The guarantee has as its central objective the removal of any uncertainty on the part of counterparties and customers and gives absolute comfort to depositors and investors that they have the full protection of the state,’ said Lenihan. The four Irish banks with Isle of Man branches protected by the scheme are:

- Anglo Irish Bank Isle of Man

Bank of Ireland Offshore

Irish Permanent International

Irish Nationwide Isle of Man

Thursday, 23 October 2008

Annuity Rates Set To Fall

Along with gilts, corporate bonds form the underlying investments used to pay annuities. With the credit market seizing up, the yields on corporate bonds have spiralled to unprecedented levels and this in turn has allowed insurers to increase annuity rates. Government measures to inject liquidity in to the market and kick start lending again will hopefully bring interest rates down. When the market does start functioning again, bond prices could jump as yields drop back. This is likely to bring downward pressure to bear on the annuity rates.

In addition, we believe that increasing longevity is constantly forcing insurers to lower rates as annuities will have to be paid for longer. Annuities are also undergoing a rapid evolution towards an individual pricing approach where the actual rate is dependent on the investor’s health and lifestyle, as seen by the rise of enhanced and postcode annuities. This drags down rates for the healthy and those living in more affluent neighbourhoods.

Tuesday, 21 October 2008

Value in Corporate Bonds ?

BlackRock's head of credit Paul Shuttleworth believes corporate bond default rates are likely to rise despite the UK Government's huge recapitalisation of banks improving sentiment towards the asset class.

BlackRock's head of credit Paul Shuttleworth believes corporate bond default rates are likely to rise despite the UK Government's huge recapitalisation of banks improving sentiment towards the asset class.However Shuttleworth thinks the current yields on corporate bonds are far too pessimistic and that the asset class is offering good value over the medium term. Shuttleworth said that a proliferation of new bond issues from financial companies was now likely as until recently the prevailing conditions had made the issue of new bonds almost non existent, but the deteriorating economic environment would make further company failures and subsequent defaults more likely. He said: 'Investor sentiment changed for the better once it became clear that the UK Government's bank recapitalisation would leave bank bondholders intact.'

'As the British lead has set a global template it is likely that sentiment will continue to improve but the flies in the ointment are that we will see financial institutions issue more bonds in the future - which they haven't been able to do until recently. With a slowing global economy company failures and subsequent bond defaults may increase.'

Despite this, Shuttleworth believes the corporate bond sector has stabilised since the recapitalisation and that the current default risks are priced in. He said: 'Historically the worst cumulative default rate for 'investment grade' bonds (BBB and above) over any 10 year period since data started being collected in the early 1970s, was 5.2%. The average default rate over any 10 years is actually 2%.'

He added that the yields currently being paid out annually on corporate bonds were pricing in a 50% default rate over the next 10 years for financials, and 30% for non-financials which he sees as hugely pessimistic. 'The pessimism in the pricing of corporate bonds is overdone - over the medium term they offer real value

Monday, 20 October 2008

It has been reported in recent press articles that Norwich Union may abandon plans to pay windfalls to its policyholders after the stock market slide slashed the value of its spare capital. The pay-outs were to be made by NU's parent Aviva from surplus capital that had built up in its with-profits funds over many years. Last year, the insurer approached policyholder advocate Clare Spottiswoode to help decide what to do with the spare cash. Spottiswoode lobbied hard for significant payouts to policyholders and Aviva said in July it would hand out windfalls averaging about £1,000. But the plan could be scrapped after the crash in stock market values hit Aviva's capital assets and eroded the pile of surplus capital.

It has been reported in recent press articles that Norwich Union may abandon plans to pay windfalls to its policyholders after the stock market slide slashed the value of its spare capital. The pay-outs were to be made by NU's parent Aviva from surplus capital that had built up in its with-profits funds over many years. Last year, the insurer approached policyholder advocate Clare Spottiswoode to help decide what to do with the spare cash. Spottiswoode lobbied hard for significant payouts to policyholders and Aviva said in July it would hand out windfalls averaging about £1,000. But the plan could be scrapped after the crash in stock market values hit Aviva's capital assets and eroded the pile of surplus capital.Half of UK adults have no pension plan

Nearly half of adults in the UK are failing to contribute anything towards a pension scheme, despite the continued trend of people living longer. New research shows that 46pc of the working population aged over 18 are not setting aside any money for pensions. A similar number (45pc) of people aged between 55 to 64 are also not currently paying towards their retirement funding.

Nearly half of adults in the UK are failing to contribute anything towards a pension scheme, despite the continued trend of people living longer. New research shows that 46pc of the working population aged over 18 are not setting aside any money for pensions. A similar number (45pc) of people aged between 55 to 64 are also not currently paying towards their retirement funding.Wednesday, 15 October 2008

What Next

Having returned from a weeks vacation I am now busy trying to bring myself up to date with the events of the last few days albeit the news was never that far away between e-mails and television. Of all the numerous articles appearing in our in-boxes the following link is perhaps one of the more opinionated I have had the pleasure of reading. As we grapple with the events of the past days and look for signs of where things are moving next we will try and post as many of the "professional" articles we come across for those interested in finding out more from those directly involved in market decisions.

Having returned from a weeks vacation I am now busy trying to bring myself up to date with the events of the last few days albeit the news was never that far away between e-mails and television. Of all the numerous articles appearing in our in-boxes the following link is perhaps one of the more opinionated I have had the pleasure of reading. As we grapple with the events of the past days and look for signs of where things are moving next we will try and post as many of the "professional" articles we come across for those interested in finding out more from those directly involved in market decisions.http://defaqtoblog.com/iabn/2008/10/15/what-next/

Tuesday, 16 September 2008

A different prospective

As we trawl through the heaps of reports winging their way into our in-boxes, in an effort to make some sense of the last few days, I append below some of the more interesting comments for those clients who can summon the courage to refelct on events.

As we trawl through the heaps of reports winging their way into our in-boxes, in an effort to make some sense of the last few days, I append below some of the more interesting comments for those clients who can summon the courage to refelct on events.In all the hullabaloo of recent months, two laws have been forgotten. Rule 1: In the long-term, price is determined by demand and supply. Rule 2: Demand falls with price. (Or as an economist would say, the demand curve slopes downwards from left to right.)

In the short-term, demand, for oil and, as it also appears, for houses, is quite inelastic – meaning that demand is not affected by price. But in the long-term this is not the case. As price goes up, demand stays put, the economy suffers. Then demand falls, and price begins to fall too. The economy recovers.

Some said that the bail out of Fannie Mae and Freddie Mac marked the turning point of the credit crunch. Events of the last few days have surely shown how wrong this view was.

The authorities are placing belief in the proposition that an investment bank such as Lehman can go out of business without triggering widespread panic in the rest of the system. At the same time, it remains the key role of authorities in the US, Europe and the UK to ensure that while shareholders are exposed, individual depositors and the banking system are protected. Confidence in these must be maintained above all else.

Wednesday, 10 September 2008

Bouncy, Bouncy Oil

Oil was down again yesterday, falling to just $102. That was the lowest price since April and $43 dollars down on the year high.

Oil was down again yesterday, falling to just $102. That was the lowest price since April and $43 dollars down on the year high.For several months now, it has been predicted here that oil was near peak, and would soon begin a steady decline. But when the fall did occur a few weeks later, we were taken a tad by surprise. It had come so quickly. But then if the credit crunch of 2008 has one overriding characteristic it is that it has all happened quickly. House prices are falling faster than the most bearish commentators would have believed, so why shouldn’t oil fall as fast too?

There is plenty of evidence, discussed here on innumerable occasions, to show how demand for oil in the US, UK and Eurozone is falling. But then this morning, OPEC reduced oil supply. “All the foregoing indicates a shift in market sentiment causing downside risks to the global oil market outlook,” said an OPEC statement.

“Actions will be taken by members as soon as they can, that means in the next 40 days,” said the Algerian Oil Minister Chakib Khelil, who chaired the OPEC meeting. The parallels with the housing market are clear. The housing market has been characterized by both suppliers and customers running a mile, and we end up with a kind of race to the bottom, with price determined by which falls the most, demand or supply. At the moment, of course, there is a limit to how much demand for oil can fall. This black liquid has, after all, been the lifeblood of the global economy for the last one hundred years or so. Even so, it seems unlikely OPEC will cut supply sufficiently to stop further falls in oil in the longer term.

Yesterday, the black stuff fell by over $4; within a few hours of the OPEC announcement it was up a couple of dollars. But, markets do tend to overreact, so the trend for oil is still likely to be down. OPEC would, in any case, be making a huge mistake if they cut supply so much that the price went shooting up again. There are alternatives to oil out there, it will just take a lot of money to develop them. But once this money has been spent, and more and more of us use these alternatives, the cost will fall. New technology works like that. Once the initial development cost is funded, price falls rapidly.

OPEC’s best interests are not served by trying to prop up the price of oil. Take into account the threat of global warming, however, and it could be argued that the world’s best interests are served by expensive oil forcing the development of renewable alternatives.

Friday, 5 September 2008

Now is not the time !

Now is not the time to ignore your life assurance and protection arrangements. In fact during these difficult times it is probably more important than ever that you can relax in the knowledge that your business and/or personal life can continue should the worst happen to you, your partner or your business partners whether by way of early death, illness or accident.

Now is not the time to ignore your life assurance and protection arrangements. In fact during these difficult times it is probably more important than ever that you can relax in the knowledge that your business and/or personal life can continue should the worst happen to you, your partner or your business partners whether by way of early death, illness or accident.The credit crunch has had a huge impact on the lending market. Homeowners are trying to borrow more money against their homes, business against their business’s and lenders are increasing the cost of borrowing, as a result of falling property prices, finances are becoming a strain for many. For some, life insruance is offering a short term solution to their financial woes. Homeowners with young families are cancelling Life Insurance policies and hoping the worst doesn’t happen, businesses are also running unwarranted risks. This could not be a worse idea. Often a new policy will cost more because the older you are the more expensive life insurance becomes, you may also lose out on some benefits and features included in your current policy.

It is far better to use alternative means to reduce outgoing and think about sacrificing things that might be putting more of a strain on your finances thank you might think. For instance, smokers who quit buying a 20-pack of cigarettes a day this time a year ago would now be £3,108 better off. Due to the increased health risks from smoking, most life assurance companies charge smokers over 50% more than they charge non-smokers. Smokers who’ve quit should ask their life assurance company to re-evaluate their original policy and charge them the cheaper ‘non-smoker’ rate once they pass the qualifying period.

Cashing in life insurance is not advisable in such situations of stress like the credit crunch. Life insurance is vital. The first step to getting life insurance is to find out what you might already be covered for. If you have an endowment mortgage, for example, this will include an element of life insurance to cover repayment of the loan on your death. It will only cover the amount originally borrowed, so if you've extended the mortgage over the years then this extra borrowing won't be paid off by the policy. So work out how much money will be needed to pay off all debts, including the mortgage, credit cards, business loans and personal loans.

Also the life insurance market is one that you can rely on during the credit crunch. Fierce competition in the life insurance market has kept premuims at reasonable levels at a time when all other household bills seem to be going up. For example, a 32-year-old male non-smoker could buy £100,000 of cover over 25 years for less than £8 per month. Even £500,000 of cover over the same period would cost less than £30 per month at current prices.

Unfortunately, in an effort to save cash, homeowners and business owners are ditching life cover. Just 20% of new borrowers are opting for life cover to protect their loans. This is not advisable and just because everyone is trying desperately to save money, this is no reason. They are underestimating the importance of life insurance and see is as non-essential.

The same argument applies for business partners. With so much pressure on keeping the business ticking over imagine the additional burden were a senior or key member of staff to suffer a critical illness or die prematurely. Apart from the tragic consequences for the immediate family, what would happen to your business? Profits, clients, business loans, responsibilities to staff, plans for the future – would all be affected in one manner or another. Business protection gives you peace of mind knowing that if anything happens to your people, plans are in place to protect.

Tuesday, 2 September 2008

Time to fix that rate?

With the base rate on hold for another month and some major lenders reducing their fixed rates, is now the time to switch to a fixed rate mortgage?

With the base rate on hold for another month and some major lenders reducing their fixed rates, is now the time to switch to a fixed rate mortgage?Probably not, say the experts who predict that fixed rates may fall further in the next few months and suggest that trackers are a better punt at the moment. Amongst the lenders that have already cut their rates Nationwide has dropped rates on all its mainstream fixed-rate mortgages and some of its tracker deals for new customers by up to 0.46 percentage points and Newcastle building society has lowered its two-year fix for borrowers with a 25% deposit from 6.20% to 6.12%.

Halifax also announced cuts of up to 0.15 percentage points to its fixed deals last week. Its five-year fix for customers with a 25% deposit has gone from 6.49% to 6.34%. BM Solutions, Bank of Scotland and Intelligent Finance, which are part of the same group as Halifax, have also made cuts as have both Cheltenham & Gloucester and Abbey.

Swap rates, the starting point that lenders use to determine the price of their fixed rates, have fallen dramatically over the last few weeks, coming down 0.7% from their peak a month ago. Even the bad news on inflation has failed to dent their progress downwards, and now lenders are, theoretically at least, able to offer better priced products. Although this sounds like good news there are still a couple of factors that might prevent fixed rates dropping straight away. Firstly, lenders have been looking to increase margin rather than market share, so have priced more profit into their products. Secondly lenders are concerned about being inundated with applications so they don't want to appear too competitive.

However with swap rates likely to decrease further with expectations that bank rate would be cut before the end of the year there may be more cuts in the next few months so borrowers that can hold out before locking into a new fixed rate might be wise to wait before they do so. Those lenders that haven't reduced their fixed rates yet also have some catching up to do. At the moment trackers and variable rates appear to be the best bet for borrowers looking for a new deal although these will be still be more expensive than most deals coming to an end.

However only borrowers with a decent deposit or plenty of equity in their property will be eligible for the deal as it comes with a maximum loan-to-value (LTV) of 60% although according to Council of Mortgage Lenders data this accounts for 50% of the mortgage market. Homeowners with a smaller deposit or less equity will be charged more, both by Woolwich and rival lenders.

Tightened criteria, such as insisting on a large deposit or large amount of equity, is a side effect of the credit crunch as lenders are becoming more fussy about who they lend to. Those with a slightly dodgy credit history or borderline affordability will also find it more difficult to get a good deal.

Friday, 22 August 2008

More than 13 million people in the UK have never reviewed their pension plan, according to new research from Baring Asset Management, but it is vitally important for clients to keep tabs on their pot to help prevent a serious shortfall in later life.

More than 13 million people in the UK have never reviewed their pension plan, according to new research from Baring Asset Management, but it is vitally important for clients to keep tabs on their pot to help prevent a serious shortfall in later life.Attitudes many people showed towards retirement planning have to change, such as keeping track of pensions and investigating options. It is important that people are keeping a check on how their preparations for the future are progressing and realise at the earliest possible moment that they have got a potential problem – when they are able to do something about it. If you realise a couple of years before you retire, it can be a bit too late.

People are losing out by not keeping their records up to date with their pension provider. People move addresses and do not notify pension providers, so they are not receiving their annual statement. Accessibility was not the only hurdle to pension awareness; apathy and a lack of trust also played key roles. In the past few years, the shocks we have had in the equity market, coupled with the adverse tax changes that have been made by Gordon Brown have generally made people more wary about pensions than they were before.

Barings’ research found that 13.6 million people in the UK had never reviewed their pension plan and a further 2.2 million had not done so in the last five years. And the results showed gender differences when it came to choosing funds, with 53% of women not knowing if they were in the default fund compared to 29% men. Marino Valensise, chief investment officer at Barings, said the low number of individuals reviewing their pension on a regular basis was ‘concerning’ and could spell a shortfall for those that were not lucky

Wednesday, 20 August 2008

The explosive conflict between Russia and Georgia has exacerbated some fund managers’ reservations on investing in the country while others believe the region is offering historically cheap buying opportunities on the back of a further sell off.

The explosive conflict between Russia and Georgia has exacerbated some fund managers’ reservations on investing in the country while others believe the region is offering historically cheap buying opportunities on the back of a further sell off.Jupiter’s Eastern European Opportunities manager Elena Shaftan, who holds a position in Bank of Georgia within her Global European Euro Select Sicav, said the events of the past week would increase Western investors’ concerns over Russia but should ultimately have little long-term impact on returns. She said: ‘Having already suffered a 20% fall since May the Russian stock market has dropped a further 10% in the past two days on the back of the military action. It is clearly a very upsetting event that has led to indiscriminate market selling and Russia’s perception in the West will suffer as a result.’

Baring’s Citywire AA-rated Eastern Europe manager Dr Ghadir Abu Leil-Cooper also did not expect the conflict to have a significant long-term impact. She said: ‘The South Caucasus is not a major economic centre for Russia, and none of the firms we invest in have significant operations in the region.’

However, Aberdeen Asset Management’s head of global emerging markets Devan Kaloo reiterated why the group was underweight Russia. He said: ‘Recent headlines haven’t really affected our view of investing in the country.

'We have been significantly underweight Russia for some years, largely due to concerns regarding corporate governance, financial disclosure, treatment of minorities and the growing role of the state in the private sector.’

Tuesday, 19 August 2008

Global Insight

On a similar theme to my last posting I attach a link to Standard Life's most recent market report.

On a similar theme to my last posting I attach a link to Standard Life's most recent market report.Given that the report is set-out in a more presentable manner than most I thought it might be of some interest to those clients looking for some insight into where markets are heading, at least in Standard Life's opinion. http://pdf.standardlifeinvestments.com/exported/pdf/GS_Insight/GS_Insight_M08_08.pdf

Friday, 15 August 2008

Credit Crunch - Stage 2 ?

It is just possible we have now reached that stage in the credit crunch when the bungee jump that is the global economy has reached the bottom for the first time. This does not mean, of course, that the world is set to boom again. The bungee jump has several more rises and falls yet before it finally stops. In any case, it all happens in very slow motion.

It is just possible we have now reached that stage in the credit crunch when the bungee jump that is the global economy has reached the bottom for the first time. This does not mean, of course, that the world is set to boom again. The bungee jump has several more rises and falls yet before it finally stops. In any case, it all happens in very slow motion.But it appears that something very significant is happening about now. There are good reasons to believe the credit crunch has reached a new stage – the last few days have seen some of the most dramatic developments to date. It was told earlier this week that the world appears to be re-aligning; well even stronger evidence has now emerged to support that view.

Has credit crunch stage 2 has begun. Demand for oil in the West is falling. And it is falling fast. Global demand is still growing, but by nowhere near as fast as was recently expected. It seems that at last we may be seeing the consequences of what happens when oil becomes too expensive.

According to the International Energy Agency (IEA), the OECD is on course to consume 48.6 million barrels of oil per day this year, compared to 49.2 million in 2007. Across the globe, oil consumption per day is likely to be around 800,000 barrels a day higher than last year. According to an article by Ed Morse, chief energy economist at Lehman Brothers in the FT earlier this week, last October, the International Energy Agency expected global demand for oil to be 2.1 million barrels a day more than in 2007. In other words, growth in demand this year is barely a third as fast as previously forecast. Demand from the OECD is 600,000 barrels a day less than last year.

Ed Morse said in the FT: “In our judgment, the IEA’s forecasts for emerging markets will turn out to have been far too optimistic by year’s end and OPEC countries will again complain about the inability of oil importers to guarantee sufficient demand growth to warrant investments in expanded production capacity.”

Mr Morse went on to expand on the theme that when prices get too high, demand falls. We start looking for alternative products. We start looking for efficiencies. Sometimes there are false dawns before a bubble bursts. The Dotcom boom saw many mini crashes followed by new peaks after the point when people started fearing a crash was inevitable. In 1928 and 1929, the stock market had several big falls that were then reversed before the crash. The current sell off in oil may well prove to be temporary, but sooner or later the oil and wider commodity bubble is set to burst.

But in the slow tick–tock of economic change, the path will be gradual. First to feel the benefit will be those who were first to feel the pain. It seems that just as the Eurozone and Japan have surprised all by seeing GDP contract before the US and UK, they are likely to recover first.

Thursday, 14 August 2008

A place in the sun?

And the rain in Spain jumps out of the drain.

And the rain in Spain jumps out of the drain.Right now, things in Spain seem to be a lot like the UK, only more so. While we fret about inflation going over 4 per cent, in Spain the 5 per cent mark has been breached. Spanish inflation in July hit 5.3 per cent, from 5 per cent in June and a Eurozone average of 4.1 per cent. But the big concern relates to Spanish house prices.

Tuesday, 12 August 2008

To fix or not to fix that is the question.....

With the base rate on hold for another month and some major lenders reducing their fixed rates, is now the time to switch to a fixed rate mortgage? Probably not, say the experts who predict that fixed rates may fall further in the next few months and suggest that trackers are a better punt at the moment.

With the base rate on hold for another month and some major lenders reducing their fixed rates, is now the time to switch to a fixed rate mortgage? Probably not, say the experts who predict that fixed rates may fall further in the next few months and suggest that trackers are a better punt at the moment.Amongst the lenders that have already cut their rates Nationwide has dropped rates on all its mainstream fixed-rate mortgages and some of its tracker deals for new customers by up to 0.46 percentage points and Newcastle building society has lowered its two-year fix for borrowers with a 25% deposit from 6.20% to 6.12%. Halifax also announced cuts of up to 0.15 percentage points to its fixed deals last week. Its five-year fix for customers with a 25% deposit has gone from 6.49% to 6.34%. BM Solutions, Bank of Scotland and Intelligent Finance, which are part of the same group as Halifax, have also made cuts as have both Cheltenham & Gloucester and Abbey.

Swap rates, the starting point that lenders use to determine the price of their fixed rates, have fallen dramatically over the last few weeks, coming down 0.7% from their peak a month ago.

However with swap rates likely to decrease further with expectations that bank rate would be cut before the end of the year there may be more cuts in the next few months so borrowers that can hold out before locking into a new fixed rate might be wise to wait before they do so. Those lenders that haven't reduced their fixed rates yet also have some catching up to do. At the moment trackers and variable rates appear to be the best bet for borrowers looking for a new deal although these will be still be more expensive than most deals coming to an end.

Friday, 8 August 2008

Equity release for cash poor predicted to grow

Equity release is becoming increasingly popular. Safe Home Income Plans recently reported equity release business by its members rose by 14% to £275 million in the second quarter of 2008.

Equity release is becoming increasingly popular. Safe Home Income Plans recently reported equity release business by its members rose by 14% to £275 million in the second quarter of 2008.We are hearing more and more that pensioners and those approaching pensionable age are going to face poverty because they have not provided enough for their retirement. As a result I think equity release is going to be something we hear more and more about and the credit crunch had boosted the appeal of equity release products. At the moment a lot of equity release rates are better than mortgage rates.

A lot of people are very asset rich but cash poor and people have often got hundreds of thousands of pounds tied up in property but a very low pension equity release could be used not only to fund retirement but also to pay off other debts such as credit cards and mortgage repayments, and even to finance holidays.

It is however a specialist area of business requiring specialist and carefully thought out advice. We advise clients to take time and fully consider all options before rushing in to an equity release arrangement. That said when it does fit the bill and all aspects are fully considered it can prove worthwhile and offer clients options they perhaps had not considered previously.

Wednesday, 6 August 2008

Stamp duty in for a licking

So the government is considering temporarily lifting stamp duty on the first £250,000 of the price paid for a home. So that means no stamp duty for homes less than a quarter of a million. And stamp duty on the value of the home minus £250,000 for the rest. It is a desperate gamble. The move will be expensive, and if it doesn’t work, it is money down the drain.

So the government is considering temporarily lifting stamp duty on the first £250,000 of the price paid for a home. So that means no stamp duty for homes less than a quarter of a million. And stamp duty on the value of the home minus £250,000 for the rest. It is a desperate gamble. The move will be expensive, and if it doesn’t work, it is money down the drain.Actually, the move from the government will be the equivalent to it handing people buying properties an amount of money worth 1 per cent of the home’s value. Or if it is worth more than £250,000, £2,500. So that means buyers find themselves getting closer to the deposit they need all the quicker.

The snag is this. It is only 1 per cent. House prices are falling by more than that each month – it is not difficult to see why this may not work. In the last house price crash, John Major tried something similar – his move failed. But a more pertinent question is this. Why does the government want to do this? When house prices were rising too fast, it stayed clear. If you believe the current housing market turmoil is all a little odd, and solely down to this credit crunch which had nothing to do with us, then the move makes sense. If you believe house prices are falling because they are too expensive, and the credit crunch is down to lending that was too high, based on property valuations that were not sustainable, then reducing stamp duty would be a fool’s errand. It seems more likely that this move will just result in a short pick up in opinion polls, followed by the loss of taxpayers’ money – never to be seen again.

Quite frankly, the government would be better off using the money it would spend on reducing stamp duty, giving us all some kind of tax credit. Vince Cable, the Liberal Democrats’ shadow chancellor, said: “The falls we are seeing in the housing market are painful, but necessary, if homes are to become affordable once more for those not on the property ladder. “Ministers allowed house prices to get hopelessly out of control. They must not now artificially prop up the market for political expediency.”

And as for the markets…….. well they had another day of celebrating yesterday – although when you drill down and examine the reason why, it does seem a tad daft. The Dow Jones soared 331 points, one of its best days of the year. The FTSE 100 rose a healthy 134 points, the German DAX index was up 168 points. But the news in the US, UK and Germany was hardly the stuff booms are made of. In fact, you could say all three economies saw a catalogue of woes yesterday.

So why did markets celebrate? Well, for one thing, the Fed stopped talking about “continued increases” in energy prices, and merely said they were “elevated.” As for growth. Last time, the Fed said the downside risks to growth “appear to have diminished somewhat.” This time it merely said “the downside risks to growth remain.” All we can conclude is that the markets are only a slight guide to what is going on, but for those interested in what is actually going on whilst equities were performing well certain popular commodities had a tougher day with Oil down 2.16% and Gold also down 14.1%.

Tuesday, 5 August 2008

A year on - credit crunch

A credit crunch is a situation in an economy where there is a sudden decrease in the availability of credit from banks and other lenders in order to reduce their risk. They may also increase the cost of obtaining credit by raising interest rates. It is a time of mild recession as the growth of debt if forced to slow, money is tied up in debt and not immediately available and there fewer liquid assets.

How did it start?

The global credit we’re now experiencing was caused when people with poor credit ratings (or “subprime credit risks”) were unable to meet higher debt higher repayments to US mortgage brokers due to rising interest rates. As more mortgages were foreclosed in America (so properties could be repossessed and then sold on for a profit), their previously buoyant housing market nosedived. These subprime losses started in early 2006 and continued to worsen throughout 2006 and into 2007.

Debts often get sold to other financial companies around the world to help create one of their sources of money which can then be invested or lent to people or companies. With little debt being paid off, financial institutions like mortgage providers and banks have been unwilling to take on more debt themselves and have little money to lend, and so these effects have spread around the world. Some firms, like Northern Rock, have been too dependent on this source of finance and have suffered as a result. There is quite some debate about whether the blame lies with consumers for putting too much on credit and overspending or whether banks are the culprits for irresponsible, high-risk lending.

How does it affect me and what can I do?

To make sure they are no longer at risk, these companies have made it harder to get loans, mortgages, and plastic by tightening their lending policies, charging higher fees, and increasing interest rates. This affects you as it means you may have fewer methods to get out of debt, spending may be cut, and your repayments may increase. The credit crunch even affects job seekers as companies are less willing to take on permanent employees in case they have to make job cuts.

Now is the time to check your credit rating because if you want to borrow money, get a mortgage or remortgage then banks are more likely to lend to someone who is not deemed as a risky investment.

Be careful with credit cards and balance transfers. Try to pay them off or reduce the debt on them as interest rates are high. It’s also more difficult to get cards for new 0 per cent rates now and any cards you get may have lower credit ratings as banks are unwilling to be as generous as before.

The main market where the credit crunch is felt is in housing. Now is a good time to either improve your home so it’s ready for when the market improves too, buy a home at auction which has been repossessed, or get a mortgage with the lowest rate possible if you’re coming to end of a fixed-rate mortgage. If you’re looking to sell your home to move or use the money to pay off debt then shifting to a smaller property or even until the economy recovers may also be a good idea.

Wednesday, 30 July 2008

Property or Pension ?

Falling property prices mean people may not get as much cash for retirement as they think and should consider making other provisions.

Falling property prices mean people may not get as much cash for retirement as they think and should consider making other provisions.Research by Friends Provident found a third of consumers were depending on property or equity release for their retirement income. However, if property prices fall to the same extent seen in the last house price crash in the early 1990s, the average homeowner could see themselves out of pocket by £89,850 based on the Council of Mortgage Lenders’ average mortgage figures.

Research shows a potential crisis for some people in the future. People have depended on the property market in the past to fund their retirement, but with the uncertainty over the past few months and the current credit crisis they should not put all their eggs in one basket.

Monday, 28 July 2008

CARE: Assessable assets.

There has been discussion for some considerable time as to whether the definition of life assurance for the purpose of the local authority means test includes an investment bond.

There has been discussion for some considerable time as to whether the definition of life assurance for the purpose of the local authority means test includes an investment bond.Indeed, in the past, some local authorities have sought to take investment bonds into account as assessable assets despite the fact that, strictly speaking, most investment bonds (other than capital redemption policies) are policies of life assurance.

The key points are as follows:

• “Income” from investment bonds will be taken into account when making assessments.

• Care should be taken to ensure that the deliberate deprivation rules are not invoked.

Thursday, 24 July 2008

Inheritance Tax has fallen under the radar for many following the Chancellor’s announcement in the 2007 Pre Budget report when he made a useful change to the IHT legislation for married couples and civil partners to ensure that they benefited from two Nil Rate Bands without the need for IHT planning on the first death.

Inheritance Tax has fallen under the radar for many following the Chancellor’s announcement in the 2007 Pre Budget report when he made a useful change to the IHT legislation for married couples and civil partners to ensure that they benefited from two Nil Rate Bands without the need for IHT planning on the first death.This is a welcome change to the legislation but should not be relied on as the solution to a couple's IHT liability. Having easily introduced the legislation, it could just as easily be withdrawn or altered. Inheritance Tax (IHT) concerns more of us than ever before. Mainly this is because the sharp rise in the value of houses over the last 10 years (by far the biggest asset for most people) has been much greater than what is known as the 'Nil Rate Band'. Below this key level (currently £315,000) you pay nothing on estates you pass on when you die. Above it, you pay 40% tax.

Wednesday, 23 July 2008

Diesel fuel theft

The number of incidents of theft of fuel from vehicles has doubled since the beginning of the year, it was revealed today.

The number of incidents of theft of fuel from vehicles has doubled since the beginning of the year, it was revealed today."We are urging drivers to be more vigilant to both protect their own fuel stock and also report anyone who is trying to make money by selling on stolen petrol." The RAC offered motorists the following tips to help reduce fuel thefts:

1. Park in well lit and preferably off-road areas whenever possible - fuel thieves don't want to be seen

2. Ensure your fuel cap is locked and secure

3. Don't encourage fuel theft - if you are offered fuel you think could have been siphoned from another vehicle, call the police. Apart from it being illegal, the fuel could be contaminated, causing damage to your vehicle's fuel system - some companies place dyes and covert marking into fuels, so you could be tracked

4. Check fuel levels when you switch off your engine and check again before you use your car again - if the level is suspiciously lower than expected, look around the vehicle for signs of theft prior to turning the key

5. If you smell fuel when returning to your vehicle, or see a puddle of liquid, keep away from the car, and don't turn on the ignition. Call your breakdown organisation, and whatever you do, don't light a cigarette whilst you're waiting!

Diesel theft:

Meanwhile, West Yorkshire Police has reported a 265% increase in diesel theft. They advised hauliers to tighten up security of their storage tanks, vehicles and commercial compounds and urged the public to be vigilant and report anyone who offered them cheap diesel.Officers said a wagon depot in Skelmanthorpe, Huddersfield, had lost thousands of pounds of fuel over the last 12 months, most recently being targeted by someone entering the compound and siphoning diesel. Kirklees Crime Reduction Officer Dave Whitteron said: "Although the police do everything they can to catch the culprits, we need the help of hauliers and motorists to prevent it from occurring." He recommended that owners of commercial compounds installed CCTV, security lighting and alarm systems, examined and secured fencing, and locked access gates out-of-hours.

Vehicles left in compounds should be fitted with lockable fuel caps and drivers should park hard up against a fence or wall to prevent easy access to the fuel cap for thieves, the officer said.

Monday, 21 July 2008

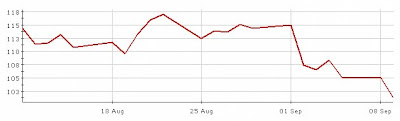

(GRAPH: FTSE-100 Index At Midday Today - 21/07/08)

(GRAPH: FTSE-100 Index At Midday Today - 21/07/08)As we continue to reach out for any good news I was quite intrigued by the following article from JP Morgan Asset Management which along with several others of late are starting to come from other angles. Still early days but maybe the start of some light.......

"The start of the great summer bounce? Weaker oil prices were the spark for a resurgence in equities this week. It provided a catalyst for a summer rally from deeply oversold levels. Indeed, our short-term timing indicators suggest there is scope for some follow through on this rally. Stocks are oversoldvs. bonds, while positioning data show that investors have savagely cut their equity weightings. Indeed, according to the Merrill Lynch Fund Managers’ survey, they are now running the highest cash weightings in the history of the series(see COTW). Moreover, sentiment is very depressed, judging by low levels of risk appetite, while global sector breadth has fallen to levels that suggest a bounceis due. Add to that an encouraging start to the Q2 US earnings season and further signs that the US economy is set to grow by an annualised 2%-2½% in Q2, with signs that restocking could partially offset the post tax rebate slump in consumption in Q3 and the markets have taken the view that the world is not about to end…yet.

However, for us the key investment question now is whether thereis a case for buying equities for more than a summer trade. We will address this question in the coming edition of the World Market Outlook, which will be released on Tuesday. We have updated analysis we undertook in March, when the market last bottomed, using a checklist of conditions required to be met to justify a higher strategicweighting to equities. Then we judged that the strategic case for risk assets was building but was not compelling.

We have updated and expanded our checklist, looking for evidencethat: (1) the credit crisis is improving; (2) that banks have done the bulk ofthe heavy lifting in recapitalising themselves; (3) that central banks are willing and able to ease further to support activity; (4) that the economic outlook for growth and inflation has become clearer, with clarity on the extent of the economic slowdown and some visibility about the peak of the inflation cycle and realism regarding 2009 earnings; and (5) that investors are paid to take equity risk. As in March, we find that the strategic case is still not compelling, although there are glimmers of encouragement on the valuation and bank recap fronts. The great summer bounce could welbe underway and indices could run further into the coming weeks, but we would not chase it from a strategic perspective."

Still on the subject of Oil

The Paris-based manager also believes it is unlikely that Saudi Arabia will spend a huge amount of money to increase production which could cause the price to go down. 'Saudi Arabia is happy to earn money and is aware that they have to keep oil in the ground for the next generation,' he says.

The AAA-rated manager cannot envisage significant falls on the demand side, particularly as oil-exporting countries such as Russia and the OPEC countries, are experiencing growing domestic consumption. 'Unless China goes into a major recession, it is difficult to see how consumption could decrease at a worldwide level,' he says.

Thursday, 17 July 2008

It is a topsy-turvy world

Yesterday was one of those busy days. The news came in from every front. In the world of banking, just for once, good news was the order of the day, but in the UK and Europe it was another day of worry.

Yesterday was one of those busy days. The news came in from every front. In the world of banking, just for once, good news was the order of the day, but in the UK and Europe it was another day of worry.Good news hit the price of oil too, as it emerged inventory levels in the US were much higher than expected, suggesting US demand for oil is falling fast. And from beyond the Great Wall, a truly promising set of data was revealed. Yet disaster also came and dealt a blow yesterday too, both in the US with news on inflation – which was just awful, and in the UK with the latest alarming job data.

Wednesday, 16 July 2008

Market whispers...

Oil sees biggest one day fall since early 1990s

Oil sees biggest one day fall since early 1990sFrom peak to trough oil fell by over $10 a barrel yesterday, and this morning when we took our daily reading stood at $138, that’s 6.8 dollar a barrel lower than the same time yesterday. (Prices from the New York Mercantile Exchange). Admittedly, in early June oil was cheaper than this. For that matter, until five weeks ago the current price would have been an all-time record. Even so, these days we need to make the most of falls like this, and ask, is this the first stage in the fall in the price of oil to more sustainable levels?

Strange days indeed, as plans develop for government to prop up house prices

“Strange days indeed,” said John Lennon once. Yesterday saw two new ideas for government intervention to prop up the housing market. The Council of Mortgage Lenders wants to see the Bank of England provide guarantees for mortgage-backed securities and covered bonds. Meanwhile, housing Minister Caroline Flint wants to see a scheme introduced to help would be first-time buyers save up for a deposit. Both ideas are interesting, but is it not the case they miss the point?

Inflation surges again, but wages go nowhere

And that devilish dilemma got a lot more devilish. Inflation is up again. Now the CPI rate is 3.8 per cent. The highest level in 11 years. The retail price index was up to 4.6 per cent, and even core inflation with alcohol, tobacco and food taken out hit 1.6 per cent.

Remortgage challenges

If you are remortgaging today, you will face a new set of challenges. Until six months ago, anyone could arrange a mortgage, but today it is the job of a seasoned professional who specialises in mortgages. All the general criteria lenders use to decide who to lend to have tightened up, and competition has virtually disappeared, so there are fewer options available to you.

If you are remortgaging today, you will face a new set of challenges. Until six months ago, anyone could arrange a mortgage, but today it is the job of a seasoned professional who specialises in mortgages. All the general criteria lenders use to decide who to lend to have tightened up, and competition has virtually disappeared, so there are fewer options available to you.Perhaps the biggest issue is for the person coming off a fixed rate from two years ago. If they are forced onto a standard variable rate, they may see payments rocket by up to 64%. Even if they are offered the best two year fixed rate, they will face a deal 35% more expensive than the one they are currently on.

Nationwide announced recently that they are now moving to quality rather than quantity in deciding which mortgage advisers they work with. A specialist Independent Financial Adviser (IFA) will know exactly how to position your case with a lender and will invariably have clout because of their buying power. A fee-charging IFA is a better option as some lenders don't pay commission, and a financial adviser not charging a fee may be less likely to use them as they will not get paid.

Ensure you look at any mortgage package in its entirety. The rate is just one part of it and other add-on fees could prove expensive. They are often added onto the loan, and whilst that is less painful, it all adds up. Watch out for being tied into your mortgage beyond the normal term at a higher rate. It is a common ploy that catches many people out. Also, if you find a good deal, act quickly, as rates are disappearing almost as they appear.

Ask your IFA to negotiate with your existing bank. A good fish that's getting away is more attractive to a fisherman than the cost of finding another.

Tuesday, 15 July 2008

Investors decisions

The phones have been hot with clients wanting to speak to their advisers about their investment options in light of the depressing news coming out of the marketplace almost on a daily basis. It really has been a torrid last few months.

The phones have been hot with clients wanting to speak to their advisers about their investment options in light of the depressing news coming out of the marketplace almost on a daily basis. It really has been a torrid last few months.There are risks attached to both strategies. If you ride it out and markets keep falling then it might prove extremely difficult to recover positions. On the other hand if you run to cash and markets respond favourably you might miss out on any resulting sharp inclines. It is all about which is the lesser evil at the moment I am afraid.

Friday, 11 July 2008

Changing times: income drawdown

Times change and people now want more flexibility and control over when and how they take retirement benefits. This is a complex area so do enlist the help of a financial planner who is qualified in pensions and investments as your guide. Provided you do not require a cast-iron guarantee for your income in retirement, and are comfortable to continue to invest your funds, then you can use what is known as Income Drawdown, or the Alternatively Secured Pension in official language. Think of this as adding a tap at the bottom of your pension pot. After taking a tax free lump sum, the tap can then be opened and closed (within government limits) depending on the level of income required. Before age 75, this can be up to 120% of the annuity available.

Times change and people now want more flexibility and control over when and how they take retirement benefits. This is a complex area so do enlist the help of a financial planner who is qualified in pensions and investments as your guide. Provided you do not require a cast-iron guarantee for your income in retirement, and are comfortable to continue to invest your funds, then you can use what is known as Income Drawdown, or the Alternatively Secured Pension in official language. Think of this as adding a tap at the bottom of your pension pot. After taking a tax free lump sum, the tap can then be opened and closed (within government limits) depending on the level of income required. Before age 75, this can be up to 120% of the annuity available.