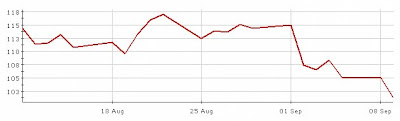

Oil was down again yesterday, falling to just $102. That was the lowest price since April and $43 dollars down on the year high.

Oil was down again yesterday, falling to just $102. That was the lowest price since April and $43 dollars down on the year high.For several months now, it has been predicted here that oil was near peak, and would soon begin a steady decline. But when the fall did occur a few weeks later, we were taken a tad by surprise. It had come so quickly. But then if the credit crunch of 2008 has one overriding characteristic it is that it has all happened quickly. House prices are falling faster than the most bearish commentators would have believed, so why shouldn’t oil fall as fast too?

There is plenty of evidence, discussed here on innumerable occasions, to show how demand for oil in the US, UK and Eurozone is falling. But then this morning, OPEC reduced oil supply. “All the foregoing indicates a shift in market sentiment causing downside risks to the global oil market outlook,” said an OPEC statement.

“Actions will be taken by members as soon as they can, that means in the next 40 days,” said the Algerian Oil Minister Chakib Khelil, who chaired the OPEC meeting. The parallels with the housing market are clear. The housing market has been characterized by both suppliers and customers running a mile, and we end up with a kind of race to the bottom, with price determined by which falls the most, demand or supply. At the moment, of course, there is a limit to how much demand for oil can fall. This black liquid has, after all, been the lifeblood of the global economy for the last one hundred years or so. Even so, it seems unlikely OPEC will cut supply sufficiently to stop further falls in oil in the longer term.

Yesterday, the black stuff fell by over $4; within a few hours of the OPEC announcement it was up a couple of dollars. But, markets do tend to overreact, so the trend for oil is still likely to be down. OPEC would, in any case, be making a huge mistake if they cut supply so much that the price went shooting up again. There are alternatives to oil out there, it will just take a lot of money to develop them. But once this money has been spent, and more and more of us use these alternatives, the cost will fall. New technology works like that. Once the initial development cost is funded, price falls rapidly.

OPEC’s best interests are not served by trying to prop up the price of oil. Take into account the threat of global warming, however, and it could be argued that the world’s best interests are served by expensive oil forcing the development of renewable alternatives.

No comments:

Post a Comment